The Transformative Impact of Cryptocurrency on Modern Finance and Society

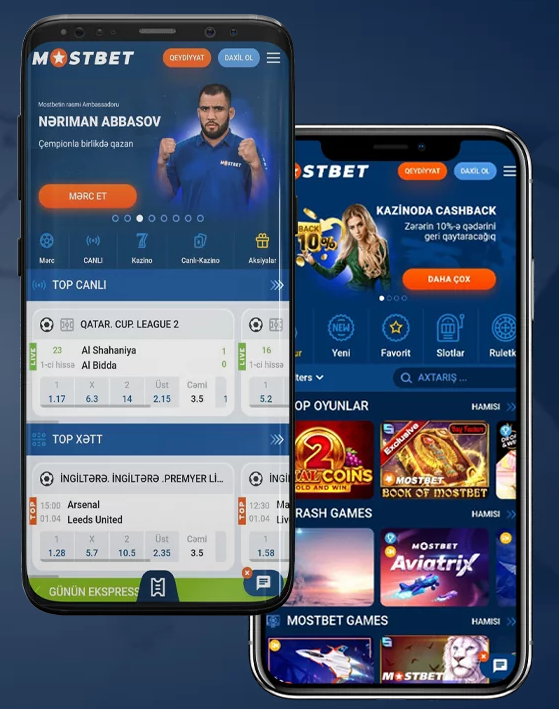

Cryptocurrency has emerged as one of the most significant technological innovations of the 21st century. Its decentralized nature, secure transactions, and potential for financial inclusion have captured the attention of individuals, businesses, and governments worldwide. In this article, we explore the multifaceted impact of cryptocurrency on various aspects of modern finance and society, including its implications for economic transactions, investment opportunities, regulatory challenges, and social change. Additionally, for those interested in digital finance, the The Impact of Cryptocurrency on Online Casinos in Bangladesh in 2026 Mostbet app offers exciting opportunities in the online betting and gaming industry, often incorporating cryptocurrency as a method of payment.

The Rise of Cryptocurrency

The advent of Bitcoin in 2009 marked the beginning of the cryptocurrency revolution. Originally designed as a peer-to-peer digital cash system, Bitcoin introduced a revolutionary concept: decentralization. Unlike traditional currencies governed by central banks, cryptocurrencies operate on blockchain technology. This technology enables secure, transparent transactions without the need for intermediaries, significantly reducing transaction costs and times. Over the years, thousands of alternative cryptocurrencies have emerged, each with unique features and use cases, contributing to an ever-expanding digital economy.

Economic Transactions Transformed

One of the most immediate impacts of cryptocurrencies is their potential to transform economic transactions. Traditional banking systems often impose significant fees and lengthy processing times, especially for international transfers. In contrast, cryptocurrencies facilitate near-instantaneous transactions at a fraction of the cost. This efficiency is particularly advantageous for individuals in developing countries who may not have access to reliable banking services. Additionally, cryptocurrency allows for microtransactions, enabling new business models and revenue streams that were previously unfeasible.

Investment Opportunities

The rise of cryptocurrency has also created a new asset class that attracts investors seeking diversification and potential high returns. The volatility inherent in cryptocurrencies presents both risks and opportunities, as traders and investors navigate rapidly changing market conditions. Initial Coin Offerings (ICOs) and later, Decentralized Finance (DeFi) platforms, have democratized access to capital, allowing startups and projects to raise funds directly from investors. However, this influx of investment has also raised concerns about fraud, market manipulation, and the lack of regulatory oversight.

Regulatory Challenges

As the influence of cryptocurrencies grows, so too does the need for regulatory frameworks to govern their use. Governments worldwide are grappling with how to approach cryptocurrency regulations, balancing the need for innovation with the need for consumer protection and financial stability. Some countries have embraced cryptocurrencies, creating favorable environments for businesses and investors, while others have implemented strict regulations or outright bans. The lack of a unified regulatory approach creates uncertainty, posing challenges for businesses and users in the cryptocurrency space.

Cryptocurrency and Social Change

Beyond finance, cryptocurrency is driving social change by promoting greater financial inclusion and empowerment. In many parts of the world, individuals lack access to basic banking services, making it difficult to save, invest, or engage in economic activities. Cryptocurrencies provide an alternative means for these individuals to participate in the global economy. Moreover, cryptocurrency can offer a safeguard against inflation and government-induced financial crises, giving people control over their assets. This potential for inclusivity is leading to innovative solutions that aim to harness cryptocurrency for social good, such as blockchain-based systems for identity verification and land ownership registration.

The Environmental Debate

However, the impact of cryptocurrency is not without controversy, particularly regarding its environmental footprint. The energy-intensive process of mining, particularly for proof-of-work cryptocurrencies like Bitcoin, has raised concerns about carbon emissions and resource consumption. Critics argue that the ecological costs of maintaining blockchain networks may outweigh the benefits, prompting discussions about sustainability within the industry. In response, some cryptocurrencies are shifting towards more energy-efficient consensus mechanisms, and there is a growing emphasis on environmental responsibility among blockchain projects.

The Future of Cryptocurrencies

Looking ahead, the future of cryptocurrencies appears promising but complex. As technology continues to evolve, it is likely that we will see further integration of cryptocurrencies within the mainstream financial system. Central banks around the world are exploring Central Bank Digital Currencies (CBDCs), which could revolutionize how money is issued and managed. Furthermore, the intersection of cryptocurrencies with emerging technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) presents new opportunities for innovation and economic growth.

Conclusion

In conclusion, the impact of cryptocurrency on modern finance and society is profound and multifaceted. It has the potential to reshape economic transactions, offer new investment avenues, drive regulatory discussions, and foster social change. As we navigate this evolving landscape, it is essential for stakeholders—including governments, businesses, and individuals—to engage in constructive dialogue and collaboration to maximize the benefits of this revolutionary technology while addressing its challenges. The ongoing development of cryptocurrencies will undoubtedly continue to spark debate, excitement, and hope for the future of financial systems worldwide.